Cold Chain Packaging Market to Hit USD 70.4 Billion by 2032 | Growing Demand for Temperature-Sensitive Products

Cold Chain Packaging Market

The cold chain packaging market is experiencing robust growth, driven by the increasing demand for temperature-controlled solutions across various industries.

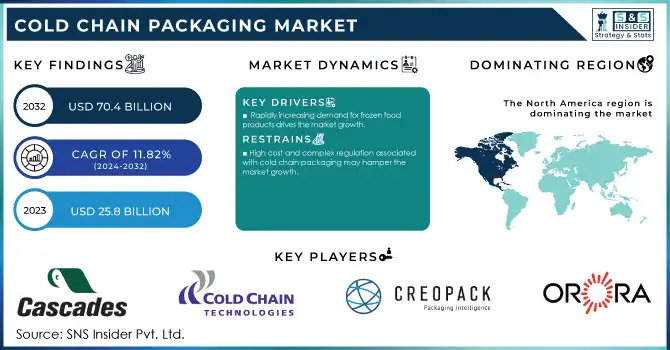

AUSTIN, TX, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The Cold Chain Packaging Market is projected to reach a valuation of USD 70.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 11.82% from 2024 to 2032.

Key Trends Fueling the Cold Chain Packaging Market

Cold chain packaging is essential for preserving the integrity of temperature-sensitive products, including pharmaceuticals, food and beverages, and chemicals. These packaging solutions ensure that products maintain the required temperature during storage and transportation, reducing the risk of spoilage and extending shelf life. The market is primarily driven by the rising demand for frozen and chilled foods, vaccines, biologics, and specialty chemicals, coupled with stringent regulatory requirements for maintaining temperature-sensitive supply chains.

Download PDF Sample of Cold Chain Packaging Market @ https://www.snsinsider.com/sample-request/2694

Key Players:

• Cascades Inc. (Insulated Containers, Protective Packaging)

• Cold Chain Technologies (TempPallet, COLDCHAINBOX)

• Creopack (CreoTemp, CreoPack)

• Orora Group (Orora Cold Chain, OroraFresh)

• Cryopak (Thermal Blankets, Cryopak EPS Containers)

• TCP Company (TCP Insulated Containers, TCP Pallet Shippers)

• Intelsius (Envirotainer, PolyBox)

• Pelican Products, Inc. (CoolPall, Pelican BioThermal Shippers)

• Softbox (E-Box, Softbox Pharma)

• Sofrigam (ThermoBox, ThermoSafe)

• Sonoco ThermoSafe (ThermoSafe, Sonoco Cold Chain Shippers)

• va-Q-tec (va-Q-tainer, va-Q-box)

• Inmark (ThermoCool, PackTech)

• Cold Chain Technologies (CryoPort, SmartBox)

• Isotemp (Isotemp ThermoBox, Isotemp Foam)

• Clariant (Clariant Pharma Packaging, Active Temperature-Control Bags)

• Sealed Air (Bubble Wrap, TempGuard Insulation)

• Vericool (Vericooler, Vericooler Biodegradable Insulation)

• APC (Advanced Polymeric Packaging, ColdChain Products)

• Isobox (Isobox CoolBox, Isobox Insulation Systems)

Increasing Use of Cold Chain Packaging in Pharmaceuticals

The pharmaceutical industry is one of the largest contributors to the growth of the cold chain packaging market. The need for temperature-sensitive drugs, such as vaccines, insulin, and biologics, has significantly increased due to advancements in biopharmaceuticals and the global focus on healthcare. The COVID-19 pandemic further highlighted the importance of robust cold chain systems, with large-scale distribution of vaccines requiring precise temperature control. As more biologic drugs and personalized medicines are developed, the demand for advanced cold chain packaging solutions continues to grow.

Rising Demand in the Food and Beverage Sector

The growing preference for fresh, frozen, and organic foods is boosting the demand for cold chain packaging in the food and beverage industry. Rising disposable incomes and changing consumer preferences for high-quality, minimally processed foods have led to an increased focus on maintaining the cold chain for perishable products. Additionally, the expansion of e-commerce and online grocery delivery services has necessitated advanced cold chain packaging solutions to ensure the safe delivery of fresh and frozen items.

Innovations in Cold Chain Packaging Technologies

The cold chain packaging market is witnessing significant technological advancements aimed at improving efficiency, reducing waste, and enhancing sustainability. Companies are investing in innovative materials and designs to create reusable and biodegradable packaging solutions, minimizing environmental impact while maintaining performance.

Advanced Insulation Materials

The development of advanced insulation materials, such as phase change materials (PCMs), vacuum-insulated panels (VIPs), and gel packs, has revolutionized cold chain packaging. These materials provide superior thermal protection and help maintain consistent temperatures over extended periods. For instance, PCMs can absorb and release heat at specific temperatures, ensuring the stability of products throughout the supply chain.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2694

Which Product Type Led the Market in 2023?

Expanded Polystyrene (EPS) is dominated the market with a share of almost 39% in 2023. This is because of its insulation, economy, lightweight and its many applications. Owing to its superior insulating property, EPS is used extensively in packaging temperature-sensitive items such as pharmaceutical, food & vaccines, making it the ideal packaging solution for retaining the desired temperature for longer duration. Light in weight and does not damage the physical product, transport friendly and firm enough to resist product damage in-transit. For companies looking for a certain cost-to-performance ratio, EPS containers are also not as pricey as alternatives such as vacuum-insulated panels or phase-change materials. In addition, EPS is a commercially available product, and by changing the step of EPS, it can design a variety of shapes and sizes to adapt to different products, this is another reason to keep it in a dominant position in the market level.

Which Application Dominated the Market in 2023?

Food held the largest market share around 48% in 2023. It is on the back of rising demand for perishable foods such as fresh produce, frozen foods, meat products, and dairy products that need to be kept in a non-temperature-variable environment all the way through the supply chain. Cold chain packaging is being used in the food industry for maintaining the safety, quality & shelf-life of food in this era of convenience & growing demand for ready-to-eat meals. Cold chain packaging solutions, such as insulated containers, refrigerants, or temperature-controlled packaging ensure that food products retain their nutritional value and vital freshness, while spoiling and waste is avoided. Transporting foods that are sensitive to temperature across larger distances is of growing importance with the increasing internationalization of trade. To meet this demand, especially in the food sector with the rapid rise in e-commerce and online food delivery services, has escalated the requirement rate of efficient cold chain packaging.

Which Region Dominated the Market in 2023?

North America dominated the cold chain packaging market in 2023, contributing over 37% of the global revenue. The region’s growth is attributed to the well-established healthcare and food industries, along with stringent regulatory standards for temperature-sensitive supply chains. The United States, in particular, plays a significant role due to its advanced logistics infrastructure and increasing demand for perishable goods.

Europe held the second-largest market share, driven by the rising demand for high-quality food products and the growth of the pharmaceutical sector. The European Union’s focus on reducing food waste and ensuring product safety has further propelled the adoption of cold chain packaging solutions.

The Asia-Pacific region is expected to witness the fastest growth during the forecast period. The expanding pharmaceutical and food industries in countries like China, India, and Japan, coupled with rising consumer awareness of product quality, are driving the demand for cold chain packaging in the region. Additionally, the growing e-commerce sector in Asia-Pacific is contributing to the increased adoption of cold chain solutions.

Recent Developments in the Cold Chain Packaging Market

• 2023:Pelican BioThermal launched a new line of sustainable packaging solutions designed for temperature-sensitive pharmaceuticals. The products are reusable and feature advanced insulation technology to maintain temperature stability.

• 2023:Sonoco ThermoSafe announced the expansion of its operations in Europe with a new facility focused on producing reusable cold chain packaging solutions. This move aims to meet the growing demand for sustainable packaging in the region.

• 2023:Softbox Systems introduced a smart cold chain packaging solution equipped with IoT-enabled sensors for real-time temperature and location monitoring. This innovation is expected to enhance supply chain visibility and reduce product losses.

Buy Full Research Report on Cold Chain Packaging Market 2024-2032 @ https://www.snsinsider.com/checkout/2694

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release