U.S. markets plunged on Thursday, erasing $2 trillion in value, as billionaire entrepreneur Mark Cuban warned consumers to stock up on everyday items before retailers use new tariffs to justify widespread price increases.

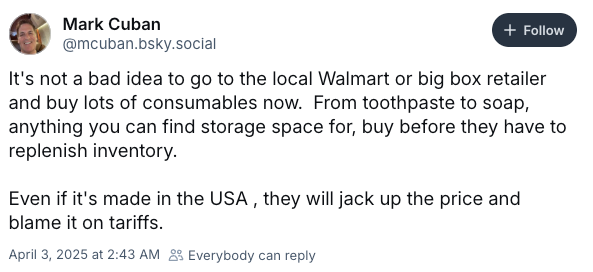

What Happened: “It’s not a bad idea to go to the local Walmart Inc. WMT or big box retailer and buy lots of consumables now,” the Cost Plus Drugs co-founder wrote on Bluesky. “From toothpaste to soap, anything you can find storage space for, buy before they have to replenish inventory. Even if made in the USA, they will jack up the price and blame it on tariffs.”

Cuban’s warning comes as President Donald Trump‘s sweeping reciprocal tariffs sent shockwaves through global markets. The S&P 500, tracked by SPDR S&P 500 ETF Trust SPY, fell 4.93%. Technology giants were hit particularly hard, with Apple Inc. AAPL down 9.25% and Amazon.com Inc. AMZN tumbling 8.98%.

The tariffs include a baseline 10% on all countries except Mexico and Canada, with higher rates for nations carrying trade deficits with the U.S. China’s tariff rate will jump to 54% from 20%. In comparison, Vietnam (46%), Indonesia (32%), Bangladesh (37%), and Cambodia (49%) also face significant increases.

Why It Matters: Evidence of economic stress appeared in the latest Institute for Supply Management report, which showed the Services Purchasing Managers’ Index falling sharply to 50.9% in March, down from 53.5% in February and barely above the 50% threshold separating expansion from contraction. The employment component plunged to 46.2% from 53.9%, with 19.2% of respondents planning to reduce staffing.

Goldman Sachs analyst Brooke Roach noted apparel, footwear, and home furnishings will likely face the steepest cost increases, with companies like RH RH and Williams-Sonoma Inc. WSM particularly vulnerable due to high sourcing exposure to Asia.

Billionaire investor Ray Dalio warned of “abrupt, unconventional changes” in global markets resulting from tariff escalation, predicting widespread stagflationary pressures as affected countries implement retaliatory measures and central banks adjust monetary policy.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.