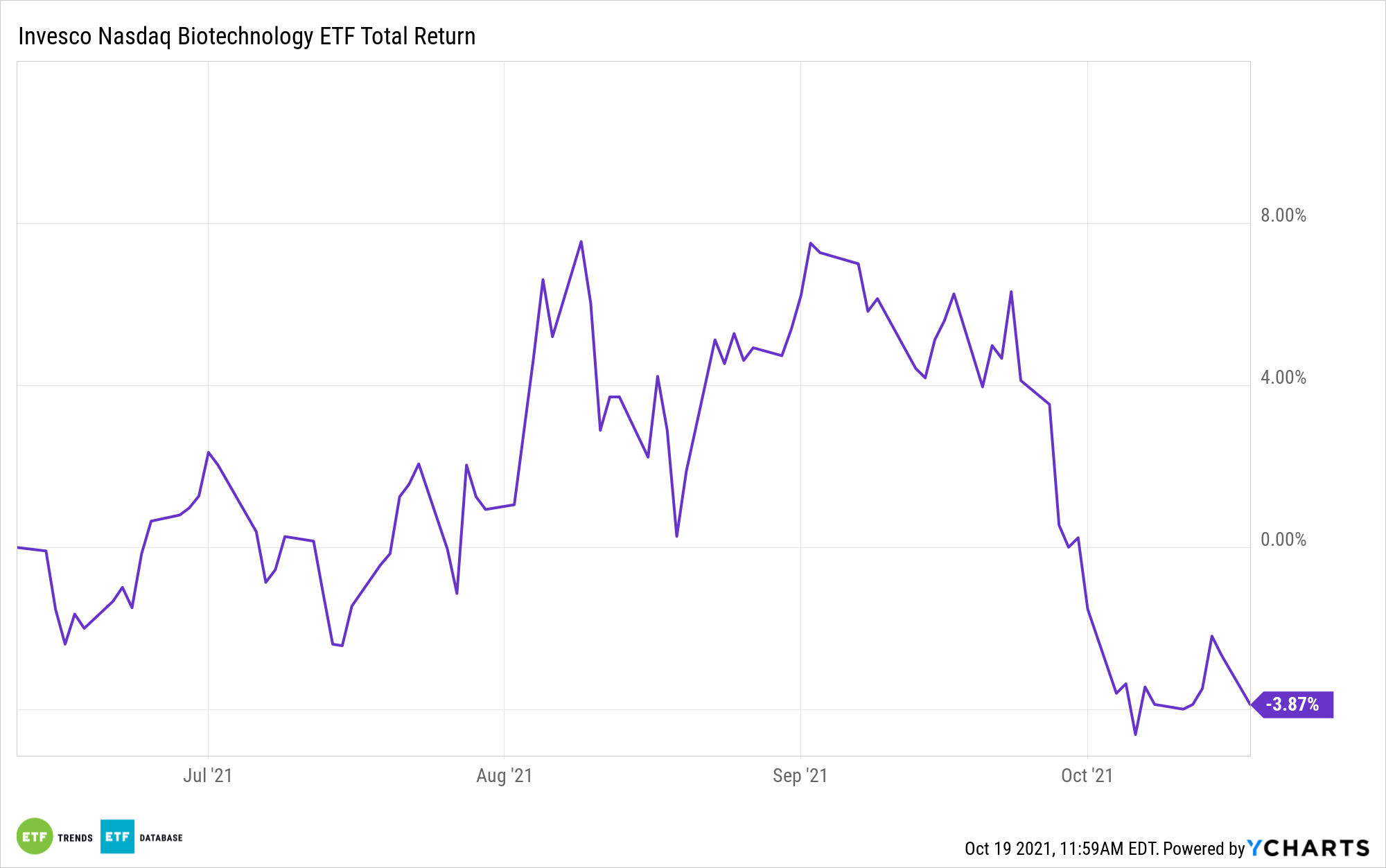

Broadly speaking, 2021 hasn’t been kind to biotechnology stocks and exchange traded funds, but some market participants remain optimistic regarding a rebound for these previously beloved assets.

One way investors can position for such an event is to lean toward higher quality, less speculative, large-cap biotech names. The Invesco Nasdaq Biotechnology ETF (IBBQ) is home to plenty of those. IBBQ, which debuted last June, tracks the widely followed Nasdaq Biotechnology Index (NBI). That’s a cap-weighted benchmark, meaning that the largest biotechnology stocks command the biggest weights.

One of the largest biotech companies is Amgen (NASDAQ:AMGN), a name some market observers are bullish on.

Amgen “discovers, develops, manufactures and delivers human therapeutics worldwide. It focuses on inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology and neuroscience,” reports Lee Jackson for 24/7 Wall Street. “The company’s five key marketed products are among the top-selling pharmaceutical products in the world, with the company having expected collective revenues of more than $25 billion in 2021.”

Moreover, Amgen yields north of 3.4% — high by any standards and downright exceptional by the standards of the biotechnology industry. The company has the means to support and grow its dividends. The consensus price target on the name is $247.45, well above the $206 area at which it currently resides.

Amgen is the largest holding in IBBQ at a weight of 8.03% as of Oct. 15, according to Invesco data.

Another large-cap biotechnology name some analysts like that also fits the bill as a quality stock is Gilead Sciences (NASDAQ:GILD).

Among other drugs and therapies, Gilead makes “Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/Eviplera, Stribild and Atripla products for the treatment of human immunodeficiency virus (HIV) infection; Veklury, an injection for intravenous use, for the treatment of coronavirus disease 2019; and Epclusa, Harvoni, Vosevi, Vemlidy and Viread for the treatment of liver diseases,” according to 24/7 Wall Street.

Gilead’s dividend yield of 4.22% is simply staggering by biotech standards, and the shares trade around $68, implying a decent amount of upside to the consensus price target of $76, though some analysts see the stock going to $100.

Gilead is IBBQ’s third-largest component at a weight of 7.45%. IBBQ holds 267 stocks, so there is ample exposure to smaller biotechnology names, but the fund’s top 10 holdings combine for over 48% of the fund’s roster.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.